What is Burial Insurance?

If you died tomorrow, how would your family pay for your burial? According to the World Population Review, the average cost of a funeral in 2020 is between $7,000 and $9,000.1 While the change in cost may not seem like much, to a grieving family the price tag may be overwhelming—which is where burial insurance comes in to help lessen the cost.

What is Burial Insurance?

Burial insurance often has different names to help soften its purpose, including but not limited to “final expense,” “memorial,” and “pre-need” insurance.2 However, no matter the name, burial insurance is designed to help families pay for burial costs and tie up any financial lose ends the deceased may have.

Burial insurance is offered by an array of life insurance companies, and offers benefits up to a certain limit. This limit is designed to help pay for burial or cremation costs that may cost upwards of thousands of dollars—helping families put their loved ones to rest with minimal financial stress.1 Since burial insurance policies differ by provider, you may find that burial insurance policies offered in the form of term or whole life depending on who you speak to.3

Generally speaking, the death benefit for a burial insurance policy is low-ranging anywhere from $5,000 to $25,000 on average, though others may have higher benefits.3 After the death of the insured, the beneficiary or beneficiaries listed can use the death benefit provided by the policy to pay for whatever they see fit, this may include funeral expenses, outstanding medical bills, legal costs, or any outstanding debts.

What You Should Know About Burial Insurance

Despite burial insurance typically being marketed towards seniors, burial insurance can be purchased for anyone at any age. In fact, burial insurance is often presented as “easy to get,” with some providers of burial insurance not even asking for a completed medical exam to qualify.2 While burial insurance policies don’t offer high death benefits, their low to mid-range death benefits can help families pay for an array of costs while remaining affordable—making it a compelling sell for those looking to provide financial security for their family at an affordable price.

To Summarize

Burial insurance can be a valuable asset for those looking for a way to help pay for their burial expenses without burdening themselves or their family. However, since there is such an array of burial insurance providers and policies available at any given time, it’s essential you do your research before committing to a single policy. By evaluating your needs, the needs of your family, and your options, you’ll be equipped to make the best possible decision about burial insurance. For any questions, we suggest you contact your local insurance agent or financial advisor.

Sources:

2. Investopedia, Burial Insurance vs. Life Insurance: What’s the Difference?, 2019, https://www.investopedia.com/articles/personal-finance/111314/burial-insurance-vs-life-insurance.asp

3. Protective, Types of Life Insurance for Funeral Costs, n.p., https://www.protective.com/learning-center/life-insurance/life-insurance-basics/is-burial-insurance-different-from-preneed-funeral-insurance/

You might also be interested in...

-

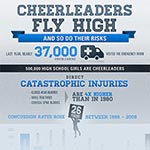

Cheerleaders Fly High, And So Do Their Risks

Cheerleaders Fly High, And So Do Their Risks

-

Dying is Expensive

Dying is Expensive

-

Funeral Costs are a Burden to the Family

Funeral Costs are a Burden to the Family

-

Jarring Concussion Dangers in High School and College Football

Jarring Concussion Dangers in High School and College Football

-

Planning A Funeral Can Save Dollars

Planning A Funeral Can Save Dollars

-

Preparation for Death Protects your Family

Preparation for Death Protects your Family

-

Preplanning Your Own Funeral

Preplanning Your Own Funeral

-

Protecting Families With Burial or Funeral Insurance

Protecting Families With Burial or Funeral Insurance

-

Should You Pre-plan Your Funeral

Should You Pre-plan Your Funeral

-

Talking to Your Parents about Burial Life Insurance

Talking to Your Parents about Burial Life Insurance

-

End Of Life Planning

End Of Life Planning

-

Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

-

Have You Reviewed Your Life Insurance Plan Lately?

Have You Reviewed Your Life Insurance Plan Lately?

-

5 Things You Must Do Before Choosing A Funeral Home

5 Things You Must Do Before Choosing A Funeral Home

-

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

-

5 Things You Need to Know About Final Expense Insurance

5 Things You Need to Know About Final Expense Insurance

-

What is Burial Insurance?

What is Burial Insurance?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from