Preplanning Your Own Funeral

A thoughtful way to help your loved ones cope with your death is to preplan your own funeral. Although it is hard to visualize our own passing, preplanning our own funeral can help your loved ones to cope with their loss. Since funeral and cemetery expenses are an expensive obligation, it is natural to prefer that we finance our own funeral, instead of burdening others. This thoughtful act will provide us with a sense of completeness, peace of mind, and security.

The purchase of funeral insurance will guarantee that your preferences will be honored. By making decisions concerning funeral arrangements and purchasing an individualized product called burial or funeral insurance, we can provide our family with time to properly grieve. And by providing our loved ones with the gift of time, they will not have to make quick financial decisions. It is common knowledge that grieving loved ones do not usually make the most informed choices. Therefore, a final expense policy will give you the power to make all the decisions concerning the products and services, instead of forcing someone else to make the choices for you. For example, what kind of outer burial container and marker would you choose? Do you have preferences concerning the size, material and style?

In fact, Bruce Dalzell, president of the Life Insurers Council asserts: "More senior citizens have the money today for these expenses. And they are independent. They don’t want to leave this burden to their loved ones."

The concept of pre-arrangement is not new, but the pre-funding of funerals is a recent development. In the past, funerals were paid with trusts. However, trusts have tax liabilities. This is the reason "final life expense" insurance policies were created.

According to the American Association of retired Persons (AARP), funerals and burials are among the most expensive purchases older Americans make. Funeral costs average over $6500 and Social Security provides only $225. And even though The Federal Trade Commission requires funeral homes to give you a price list of goods and services, it is important to note that funeral directors do not have to provide price guarantees. By planning ahead you can guarantee that the burden of paying for your funeral does not fall unexpectedly on your loved ones.

You might also be interested in...

-

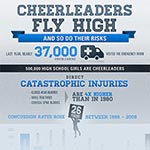

Cheerleaders Fly High, And So Do Their Risks

Cheerleaders Fly High, And So Do Their Risks

-

Dying is Expensive

Dying is Expensive

-

Funeral Costs are a Burden to the Family

Funeral Costs are a Burden to the Family

-

Jarring Concussion Dangers in High School and College Football

Jarring Concussion Dangers in High School and College Football

-

Planning A Funeral Can Save Dollars

Planning A Funeral Can Save Dollars

-

Preparation for Death Protects your Family

Preparation for Death Protects your Family

-

Preplanning Your Own Funeral

Preplanning Your Own Funeral

-

Protecting Families With Burial or Funeral Insurance

Protecting Families With Burial or Funeral Insurance

-

Should You Pre-plan Your Funeral

Should You Pre-plan Your Funeral

-

Talking to Your Parents about Burial Life Insurance

Talking to Your Parents about Burial Life Insurance

-

End Of Life Planning

End Of Life Planning

-

Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

-

Have You Reviewed Your Life Insurance Plan Lately?

Have You Reviewed Your Life Insurance Plan Lately?

-

5 Things You Must Do Before Choosing A Funeral Home

5 Things You Must Do Before Choosing A Funeral Home

-

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

-

5 Things You Need to Know About Final Expense Insurance

5 Things You Need to Know About Final Expense Insurance

-

What is Burial Insurance?

What is Burial Insurance?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from