Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

The tragedy of a loved one’s passing brings so many burdens to the surviving family members: grief, fatigue, and financial questions. You have to plan and have a funeral, and then somehow deal with the overwhelming task of notifying creditors of their passing. Then there’s the life insurance. Does it have to pay outstanding debts of the decedent? How does all of this work?

Who Is Responsible For The Debts of the Deceased?

When someone dies, their estate (everything owned at the time of death) may go into probate, during which the will is reviewed and the administration of the estate is handled.1 The estate is generally responsible to meet the obligations of the deceased. However, other surviving family members may still be fiscally responsible if the deceased had co-signers on any loans or was married in a community property state and has a surviving spouse. Inheritors of estate property, such as a house, car, boat, etc. that are subject to a nonrecourse debt are still required to either pay off any outstanding balance—sometimes by selling the property—or take over remaining payments until the debt has been paid in full.

What is a Beneficiary?

Retirement accounts and life insurance policies generally have someone named to receive or inherit the proceeds in the event of the owner’s death. That person is called the “beneficiary.” Designating a beneficiary for these accounts not only clarifies your asset recipients, but it also makes it easier for them to receive the proceeds and avoid waiting for the probate process to be completed.2

Beneficiaries and Their Responsibilities

Thankfully, if you are named the primary beneficiary—the person to whom the payout normally goes to in the event of the policyholder’s death—that money is yours and is not usually required to cover the insured’s remaining debts. There are exceptions, however.

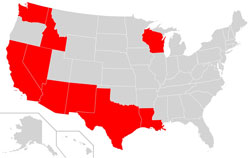

If your name is listed on any existing debt, perhaps as a cosigner, or you live in a community property state, your current assets (including life insurance inheritance) may be subject to community property rules and taxes at the state level. As of 2018, 9 states impose community property laws: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.3 “Community Property” is defined under the law of each individual state. To determine if life insurance proceeds are included in your state you should seek legal advice specific to the state laws you are subject to.

by Legalskeptic - Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=16037686

Additionally, if the estate is paid as the beneficiary, the proceeds from any retirement accounts or life insurance policies would go to the estate itself versus an individual. In that case, the benefits can be used to pay any outstanding debt.2 Additionally, a will can give the executor of an estate permission to cover certain obligations with the life insurance proceeds.4

Estate Planning

Planning ahead is one of the best choices you can make to protect your loved ones, or help aging parents with estate organization. While life insurance beneficiaries are typically not required to use the money to pay off debts owed by the estate, things such as funeral costs may be their obligation, and not that of the estate. Having a strategy in place can help provide peace of mind for those left behind.

Protection against the unexpected is exactly what life insurance was designed to provide. It is imperative to have the right amount of insurance coverage that is best for you and your family. But just as important is ensuring that the coverage you have and the designations you’ve chosen are the most suitable for any post-mortem debt and tax obligations. By having a plan in place, you can safeguard your family’s legacy and continue to have a positive influence on their futures.

2. Garber, Julie. (2018, October 20). When Life Insurance Is Part of an Estate. Retrieved from https://www.thebalance.com/must-life-insurance-be-used-to-pay-a-decedent-s-bills-3505232

3. Laurence, Bethany K. Debt and Marriage: When Do I Owe My Spouse’s Debts? Retrieved from https://www.nolo.com/legal-encyclopedia/debt-marriage-owe-spouse-debts-29572.html

4. Real Insurance. (2018, August 6). Understanding How Debt Impacts Life Insurance Payouts. Retrieved from https://www.realinsurance.com.au/life-insurance/insurance-matters/how-debt-impacts-life-insurance

You might also be interested in...

-

Cheerleaders Fly High, And So Do Their Risks

Cheerleaders Fly High, And So Do Their Risks

-

Dying is Expensive

Dying is Expensive

-

Funeral Costs are a Burden to the Family

Funeral Costs are a Burden to the Family

-

Jarring Concussion Dangers in High School and College Football

Jarring Concussion Dangers in High School and College Football

-

Planning A Funeral Can Save Dollars

Planning A Funeral Can Save Dollars

-

Preparation for Death Protects your Family

Preparation for Death Protects your Family

-

Preplanning Your Own Funeral

Preplanning Your Own Funeral

-

Protecting Families With Burial or Funeral Insurance

Protecting Families With Burial or Funeral Insurance

-

Should You Pre-plan Your Funeral

Should You Pre-plan Your Funeral

-

Talking to Your Parents about Burial Life Insurance

Talking to Your Parents about Burial Life Insurance

-

End Of Life Planning

End Of Life Planning

-

Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

-

Have You Reviewed Your Life Insurance Plan Lately?

Have You Reviewed Your Life Insurance Plan Lately?

-

5 Things You Must Do Before Choosing A Funeral Home

5 Things You Must Do Before Choosing A Funeral Home

-

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

-

5 Things You Need to Know About Final Expense Insurance

5 Things You Need to Know About Final Expense Insurance

-

What is Burial Insurance?

What is Burial Insurance?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from

Corey A. Jones is Globe Life’s Senior Vice President of Branding and Digital Marketing. He has worked in the insurance industry for nearly 20 years. In addition to holding a degree in Organizational Leadership from Southern Nazarene University, he is also a Fellow of the Life Management Institute through LOMA, an international education and trade association for insurance and financial services.

Corey A. Jones is Globe Life’s Senior Vice President of Branding and Digital Marketing. He has worked in the insurance industry for nearly 20 years. In addition to holding a degree in Organizational Leadership from Southern Nazarene University, he is also a Fellow of the Life Management Institute through LOMA, an international education and trade association for insurance and financial services.