Preparation for Death Protects your Family

By preparing for death, you will gain the comfort of knowing that, in the event of our untimely death, you will have avoided many of the undesirable ramifications by taking control of the dying process. This is accomplished by making rational decisions and taking the steps to plan your estate, thereby gaining protection of your accumulated assets.

Having both a will and a life insurance policy are the best ways to protect your family and allow them to benefit from what you worked hard to earn. Most parents are extremely concerned about what will happen to their children in the event one or both parents die. A will allows you to determine who you would want to take care of your children, and a life insurance policy is an asset that can provide guardians with the necessary funds.

We know that the sad truth is that many families who have suffered the loss of their financial provider have had their lives shattered due to insufficient funds. Families have become uprooted, forced to move, and children lack the tuition needed for their education. A common concern, when we do allow ourselves to think of our own death, is that we will lose the ability to financially protect our dependents. However, the primary purpose of life insurance is to provide an amount of money to a beneficiary when he or she needs it the most, at the death of the insured.

By planning for the protection of our assets, and providing a cushion against the financial impact on your loved ones, they will gain some equivalent of your earning power, which will end with your death. Moreover, by leaving them a legacy of caring and responsible concern, the protection will express the strong feelings you had for their welfare.

The lives of families become ruined, and they are forced to become dependent on society because the financial provider, who may have been an otherwise wonderful person, died prematurely. Having life insurance is a method of restoring your earning power. By paying the price of a contract, you will protect your assets, and leave behind the legacy you want.

You might also be interested in...

-

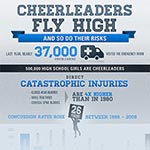

Cheerleaders Fly High, And So Do Their Risks

Cheerleaders Fly High, And So Do Their Risks

-

Dying is Expensive

Dying is Expensive

-

Funeral Costs are a Burden to the Family

Funeral Costs are a Burden to the Family

-

Jarring Concussion Dangers in High School and College Football

Jarring Concussion Dangers in High School and College Football

-

Planning A Funeral Can Save Dollars

Planning A Funeral Can Save Dollars

-

Preparation for Death Protects your Family

Preparation for Death Protects your Family

-

Preplanning Your Own Funeral

Preplanning Your Own Funeral

-

Protecting Families With Burial or Funeral Insurance

Protecting Families With Burial or Funeral Insurance

-

Should You Pre-plan Your Funeral

Should You Pre-plan Your Funeral

-

Talking to Your Parents about Burial Life Insurance

Talking to Your Parents about Burial Life Insurance

-

End Of Life Planning

End Of Life Planning

-

Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

-

Have You Reviewed Your Life Insurance Plan Lately?

Have You Reviewed Your Life Insurance Plan Lately?

-

5 Things You Must Do Before Choosing A Funeral Home

5 Things You Must Do Before Choosing A Funeral Home

-

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

-

5 Things You Need to Know About Final Expense Insurance

5 Things You Need to Know About Final Expense Insurance

-

What is Burial Insurance?

What is Burial Insurance?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from