5 Things You Need to Know About Final Expense Insurance

While researching into life insurance, you’ve probably come across the term “final expense.” Final expense insurance is a policy you can get to help pay for funerals and other medical expenses tied to your passing. Before purchasing a policy, talk to a local licensed insurance Agent and consider the following information.

1. There are two types of final expense insurance

There are two types of final expense insurance: simplified issue and guaranteed issue. Simplified issue policies typically don’t require medical exams, more so just a lengthy medical questionnaire to get a sense of your health history. Guaranteed issue policies generally don’t require medical exams or health questionnaires, depending on the company. The difference between the two can be found in the qualifications necessary to receive a policy as well as in the coverage provided by them.1

2. You can choose your beneficiary

Final expense insurance gives you the opportunity to choose who you would like your beneficiary to be. This means the funds from your policy after you pass can go to whomever you choose. Rather than a court system determining where the funds should be paid, you have a say in who should get them, making it possible to best help your loved ones.1

3. There is typically a two-year waiting period on final expense insurance

In most cases, there is a waiting period for a final expense policy. A waiting period is the time you have to wait before you reap the full benefits of your policy. If you die before the waiting period is over, then you will only receive a benefit of what you have paid in premiums.

4. Generally, final expense insurance is less expensive to buy when you’re younger

In majority of cases, you have fewer health problems the younger you are. Because of this, it is typically less expensive to purchase a final expense policy when you are younger.

5. Why you need final insurance coverage

Final expense insurance is a sigh of relief for your loved ones after you’ve passed. Funerals and medical bills can be very expensive these days, so your coverage can help your loved ones immensely. The average cost of a funeral today is around $15,000.2 Not to mention, whatever is left over after funeral expenses, your death benefit can be used to help pay off other expenses related to your death.

It is best to contact a licensed life insurance Agent to get a better understanding of final expense insurance and how it differs from other policies.

Sources:

2. Goodfinancialcents.com, Average Funeral Costs and Expenses, 2019, https://www.goodfinancialcents.com/average-funeral-costs-expenses/

You might also be interested in...

-

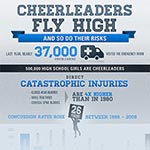

Cheerleaders Fly High, And So Do Their Risks

Cheerleaders Fly High, And So Do Their Risks

-

Dying is Expensive

Dying is Expensive

-

Funeral Costs are a Burden to the Family

Funeral Costs are a Burden to the Family

-

Jarring Concussion Dangers in High School and College Football

Jarring Concussion Dangers in High School and College Football

-

Planning A Funeral Can Save Dollars

Planning A Funeral Can Save Dollars

-

Preparation for Death Protects your Family

Preparation for Death Protects your Family

-

Preplanning Your Own Funeral

Preplanning Your Own Funeral

-

Protecting Families With Burial or Funeral Insurance

Protecting Families With Burial or Funeral Insurance

-

Should You Pre-plan Your Funeral

Should You Pre-plan Your Funeral

-

Talking to Your Parents about Burial Life Insurance

Talking to Your Parents about Burial Life Insurance

-

End Of Life Planning

End Of Life Planning

-

Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

-

Have You Reviewed Your Life Insurance Plan Lately?

Have You Reviewed Your Life Insurance Plan Lately?

-

5 Things You Must Do Before Choosing A Funeral Home

5 Things You Must Do Before Choosing A Funeral Home

-

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

-

5 Things You Need to Know About Final Expense Insurance

5 Things You Need to Know About Final Expense Insurance

-

What is Burial Insurance?

What is Burial Insurance?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from