Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

Long-term care can be very expensive and can completely deplete a lifetime of savings. However, is having long-term care insurance the answer for providing protection against the high-cost of long-term care? Can it provide a safety net for those who may eventually require skilled nursing care?

The following are the advantages and disadvantages of long-term care insurance that may help you decide the best alternative to paying for skilled nursing care:

- The odds of needing long-term care insurance — Although some seniors may require care in a skilled nursing facility, the odds of needing long-term care may be minimal and not worth the expensive premiums, as many would qualify for protection under the laws of Medicaid. However, there are instances when long-term care insurance is a good idea. For example, if you have a net worth of more than $300,000 to $500,000, long-term care insurance may actually protect your assets, especially if your policy will provide for care in an assisted living facility.

Predicting whether or not you will ever use long-term care insurance is a risk. No one can foresee what their health and finances may look like in the future, but if you consider how much you may spend on insurance premiums for long-term care insurance from age 65 to age 80, the cost could be too much. Your money may actually be better spent by investing in a retirement fund. - Statistics of needing long-term nursing care — Statistics show that two-thirds of all men and one-third of all women, age 65 and older will never require long-term care in a nursing facility.

Research has also shown that only about ten percent of men and approximately 25 percent of women age 65 and older will actually spend more than a year in a skilled nursing facility. In addition, only about ten percent of all residents in a skilled nursing facility will be confined longer than three years. On average, only about half of all nursing facility stays last six months or less. The average stay in a skilled nursing facility is approximately 18 to 20 months.

According to consumer and financial reports, experts agree that long-term care insurance is generally only a good investment if the monthly premium is 5% or less of your monthly income. If at age 80, your assets, including your home are over $300,000 and your monthly income is over $50,000 per year, then long-term care insurance may be a way to protect your assets.

For the best results in choosing long-term care insurance, be sure to compare several policies and companies, checking exclusions and limitations of each policy. You can also check consumer reports when comparison shopping. Seeking the advice of a financial advisor may help you make the right decision that will fit your needs.

You might also be interested in...

-

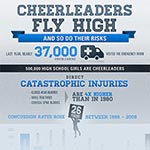

Cheerleaders Fly High, And So Do Their Risks

Cheerleaders Fly High, And So Do Their Risks

-

Dying is Expensive

Dying is Expensive

-

Funeral Costs are a Burden to the Family

Funeral Costs are a Burden to the Family

-

Jarring Concussion Dangers in High School and College Football

Jarring Concussion Dangers in High School and College Football

-

Planning A Funeral Can Save Dollars

Planning A Funeral Can Save Dollars

-

Preparation for Death Protects your Family

Preparation for Death Protects your Family

-

Preplanning Your Own Funeral

Preplanning Your Own Funeral

-

Protecting Families With Burial or Funeral Insurance

Protecting Families With Burial or Funeral Insurance

-

Should You Pre-plan Your Funeral

Should You Pre-plan Your Funeral

-

Talking to Your Parents about Burial Life Insurance

Talking to Your Parents about Burial Life Insurance

-

End Of Life Planning

End Of Life Planning

-

Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

-

Have You Reviewed Your Life Insurance Plan Lately?

Have You Reviewed Your Life Insurance Plan Lately?

-

5 Things You Must Do Before Choosing A Funeral Home

5 Things You Must Do Before Choosing A Funeral Home

-

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

-

5 Things You Need to Know About Final Expense Insurance

5 Things You Need to Know About Final Expense Insurance

-

What is Burial Insurance?

What is Burial Insurance?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from