Have You Reviewed Your Life Insurance Plan Lately?

Life can change drastically in a short amount of time and major life events can impact your life insurance coverage. The life insurance plan that fit you five or ten years ago may not be the right plan for you now.

Life events like marriage, the birth of a child, career changes and even the purchase of a new home all change the financial burden your family may be left with if something unexpected happens to you. As your life evolves and changes, your life insurance policy should also evolve and change.

If you purchased a life insurance policy in your 20s or 30s, your situation will likely change by the time you reach 40. Just like you upkeep your home to maintain its value, you should also keep your life insurance policy up to date to ensure your family will benefit from it the best way possible.

When reevaluating your policy, however, knowing what plan best fits your needs may be the challenge you find most difficult. The following are tips to help you find the insurance policy that will best fit your needs.

Estimate your living expenses. If your family has grown since you originally took out an insurance policy, you may need more coverage to pay for any additional living expenses if something were to happen to you. Make a list of your expenses that need to be covered by the insurance policy to ensure your family would not have to worry about replacing your income. In addition, if you have an insurance policy through work, it still might not be enough to cover your expenses safely in the event of your passing. If this is the case, you will need to purchase an additional policy.

Calculate your debt. You should consider an insurance policy that will cover the amount of debt you owe to make sure your family will not be burdened with any debt you leave behind. Not only do you need to calculate possible medical and final expenses, you should also include any credit card debt, mortgage, school loans, car loans and estate taxes your family may be responsible for after you are gone.

Calculate the future. Not only should you calculate the amount you may need for debt, you should also calculate what your family would need for the future. The amount of life insurance you need should include things like college tuition for your children or the purchase of a different home. You should even consider the immediate future after your death, like the high costs of funeral expenses.

Re-calculate at retirement. When you retire, you will want to once again re-evaluate the amount of life insurance you need. The amount of debt that you once owed in your 30s and 40s may be paid off when you retire. College tuition, mortgages and many other debts may no longer exist and it may be possible to lower the amount needed for life insurance. You can in turn lower the premiums associated with large policies.

Further, any retirement savings that has been growing over the years may also help lower the amount of life insurance needed. You should always have the amount of life insurance your family needs to live comfortably, but if you are able to lower your insurance premium amount by taking out a smaller insurance policy, it may be a way to save financially if needed.

You might also be interested in...

-

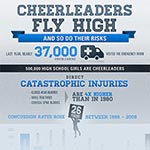

Cheerleaders Fly High, And So Do Their Risks

Cheerleaders Fly High, And So Do Their Risks

-

Dying is Expensive

Dying is Expensive

-

Funeral Costs are a Burden to the Family

Funeral Costs are a Burden to the Family

-

Jarring Concussion Dangers in High School and College Football

Jarring Concussion Dangers in High School and College Football

-

Planning A Funeral Can Save Dollars

Planning A Funeral Can Save Dollars

-

Preparation for Death Protects your Family

Preparation for Death Protects your Family

-

Preplanning Your Own Funeral

Preplanning Your Own Funeral

-

Protecting Families With Burial or Funeral Insurance

Protecting Families With Burial or Funeral Insurance

-

Should You Pre-plan Your Funeral

Should You Pre-plan Your Funeral

-

Talking to Your Parents about Burial Life Insurance

Talking to Your Parents about Burial Life Insurance

-

End Of Life Planning

End Of Life Planning

-

Pros And Cons Of Long-Term Care Insurance

Pros And Cons Of Long-Term Care Insurance

-

Have You Reviewed Your Life Insurance Plan Lately?

Have You Reviewed Your Life Insurance Plan Lately?

-

5 Things You Must Do Before Choosing A Funeral Home

5 Things You Must Do Before Choosing A Funeral Home

-

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

Debt After Death: As a Policy Beneficiary, What Do I Have To Do?

-

5 Things You Need to Know About Final Expense Insurance

5 Things You Need to Know About Final Expense Insurance

-

What is Burial Insurance?

What is Burial Insurance?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from