Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

If you own a whole life insurance policy, as you know, there were many good reasons for you to purchase such a policy. When people make the decision to purchase a whole life insurance policy, they are often in the process of experiencing a major life-altering event, such as getting married, starting a family, or purchasing a home. Owning whole life insurance is very important to ensure our sense of security.

Maybe your circumstances have changed since you purchased the whole life policy and you’re considering selling it. According to Investopedia.com, this is referred to as a life settlement, which is defined as “the selling of one’s life insurance policy to a third party for a one time cash payment. The purchaser then becomes the beneficiary of the policy and begins paying the premiums.” (This is similar to a viatical settlement.) The purchaser is typically an experienced institutional investor and the face amounts of policies will be $250,000 or more.1 (For more information on the difference between life settlements and viatical settlements, you can visit Investopedia.com.)

You may be considering selling your whole life insurance policy because you can’t afford the premiums or because you no longer have people who financially depend on you. Selling the policy removes your coverage as well as any death benefit your beneficiaries would have received, but you may decide the cash payout is worth it (that is, if you are able to sell your policy).2

Shopping around to multiple brokers until you find the best deal may be the best strategy. You should be aware that the lower life expectancy you have, “the more you can sell your policy for,” because buyers are hoping to collect on the death benefit of the policy sooner, rather than later. You may not even be able to find a buyer unless you’re very old or terminally ill. And while the viatical settlement may be higher than the cash value of your whole life policy, it will not be higher than the death benefit.3

So if you’re considering selling your whole life policy, you should consider if you’d rather have a higher payout to your beneficiaries after your death or a lower life/viatical settlement for yourself.

It’s important to think about all the financial outcomes of selling your whole life insurance policy and whether or not it makes sense for you and your family. According to nerdwallet.com, “some of the money from a life settlement may be taxed as income or capital gains” and it may come with other financial obligations, as well.4

If you have any questions about selling a whole life insurance policy, please contact a financial advisor.

1. “Life Settlement,” Investopedia, https://www.investopedia.com/terms/l/life_settlement.asp

2. “Considerations when selling a life insurance policy,” NerdWallet, https://www.nerdwallet.com/blog/insurance/considerations-when-selling-life-insurance-policy/

3. “Life Settlement,” Investopedia, https://www.investopedia.com/terms/l/life_settlement.asp

4. “Considerations when selling a life insurance policy,” NerdWallet, https://www.nerdwallet.com/blog/insurance/considerations-when-selling-life-insurance-policy/

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

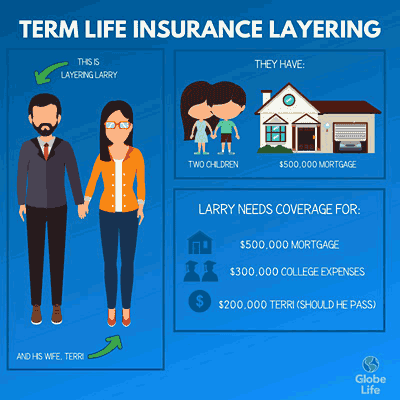

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from