Insurance Myths

Securing a life insurance policy is something everyone should consider, regardless of the myths about life insurance that are floating around. Not getting the coverage you need can leave your family financially devastated. It’s important to think about how much insurance you should have in your life to ease the burden on your family if you were gone.

Whether you may be young or single or think there are other reasons to wait, life is unpredictable and it can change in an instant. An unexpected death could leave loved ones with overwhelming expenses. Who will take care of these for you? Most likely a close family member or friend will have to find a way to cover the high costs of unexpected final expenses. When you’re young, you don’t want to think about death, so it’s easy to tell yourself “that won’t happen to me.” The truth is it can happen to anyone at any time. Life insurance can provide your loved ones with the financial support they need to help with final expenses and any debt you may leave behind. Another benefit of purchasing life insurance at a young age is it can be much less expensive.

Sometimes when looking at life insurance policies, it may seem like there are too many options. It is true that there are several different plans and options when it comes to choosing life insurance. You often hear terms like riders or waivers, along with other things you may not be familiar with. It can leave you confused and overwhelmed. You can make things easier, however, by keeping your decision to two affordable options: term or whole life insurance. Making the decision between these two choices depends on what you need and what you can afford right now.

Another life insurance myth is that only the main breadwinner in the family needs life insurance. Most people assume there is no income lost if something happened to a stay-at-home parent. According to the Bureau of Labor Statistics, it would cost $59,862.30 a year to replace a stay-at-home parent’s salary. For example, if the stay-at-home parent did suddenly pass away, who would take care of the children ... a nanny or daycare? Having the adequate life insurance coverage can help relieve some of the financial burden until you are able to adjust to a new situation.

Life insurance is too expensive. According to the Life Insurance and Market Research Association (LIMRA), 80% of people overestimate the actual cost of life insurance. LIMRA also found those under the age of 25, overestimated the cost by as much as four times the actual cost. This is probably the most misunderstood myth. In reality, term life insurance rates can be as low as $10 - $20 a month. That is less than the average person spends on coffee or eating out in a single month. With rates that low, almost anyone can afford to have life insurance.

It’s possible you may think that once you have life insurance, there is no need to worry about it anymore. If you already have life insurance, the amount of coverage you need can change. The older you get, you will acquire more debt and final expenses increase. It’s always a good idea to review your insurance needs when you have a major life change or simply review your policy every few years. Making sure your policy contains the correct information can insure your family receives the financial security they need.

Another common misconception about life insurance is that you’re better off investing your money rather than buying life insurance. The problem with that idea is that you are taking a big chance when you depend solely on your investments to take care of your family. If something happens to you and you don’t have coverage, there may be no means to provide for them after your assets are gone. Therefore, do not just count on your assets being enough, but establish a life insurance policy outside of the investments you have. This will ensure that your family has enough available money when something unexpected happens.

There are definitely many misunderstandings about life insurance. It is best to know the facts and don’t let the myths stop you from choosing the right coverage.

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

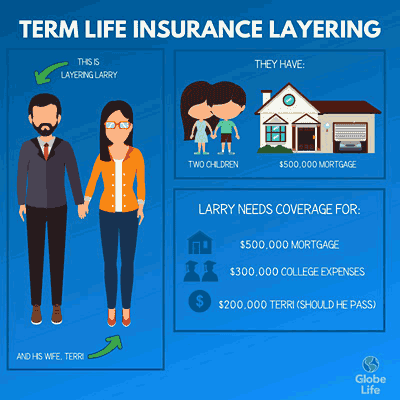

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from