How To Deal With Debt During A Divorce

Dealing with debt during a divorce is far from pleasant, but it doesn’t have to mean the end of your financial security. This is true even when splitting with a spouse means facing the debt that was incurred during both the marriage and the divorce itself.

Ideally, you and your spouse will be able to come to an agreement in which both of you take responsibility for the debts you incurred equitably. Although, that isn’t the way it always works out. If you’re struggling with debt and divorce at the same time, you might want to consider some helpful ideas before making decisions for your financial future.

If at all possible, try to work out debt issues before filing for divorce. This will require you to work together with your spouse, and it will make things easier than waiting until you file to discuss debt. Attempt to transfer balances that aren’t yours into your spouse’s name only. Mortgages and car loans might need to be refinanced in one person’s name. Remove your name from any and all debt accounts that aren’t yours if you can. Discuss your plan with your attorney before filing any financial paperwork.

Your legal liability for any debt incurred during the marriage will vary depending on whether you live in a community property state or an equitable distribution state. In a community property state both spouses may be equally liable legally for any debt, regardless of who created it. In an equitable distribution state courts assign the responsibility for debt to the person judged to have incurred that debt.

There are nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. The remaining 41 states are equitable distribution states. Even if you live in a community property state, discussing who should pay what debt with your spouse before filing might help you avoid paying debt that isn’t yours.

Should your ex-spouse decide to file for bankruptcy due to overwhelming financial obligations you could be negatively impacted. Bankruptcy doesn’t eliminate joint debts. What it does is erase the filer’s legal liability for the debt. This means that the creditors are then able to go after the non-filing ex-spouse to attempt to collect the remainder of that debt.

If you’re not the one that filed, you could be stuck paying joint debts incurred in marriage by yourself. If both you and your ex-spouse file for bankruptcy, then your liability for that joint debt would also be wiped out.

Even after your divorce is over you’ll need to protect your credit. If you had only joint credit cards, be sure that your ex-spouse’s name is removed from all of the ones you plan to use in the future. You may also need to open up new lines of credit in your name only. No matter how much you may trust an ex-spouse or how much they may claim to need to remain on your cards, try not to give in. Joint credit is complex even for married couples. For recently divorced couples, it’s a nightmare.

Once you establish your own credit post-divorce and are completely free from all responsibility for an ex-spouse’s debts, guard your credit carefully. Divorce can often make it more difficult for you to obtain credit, whether due to high balances of owed debt, missed payments or reduced income. Don’t ever miss a payment and keep your credit balances as low as possible to earn a great credit score.

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

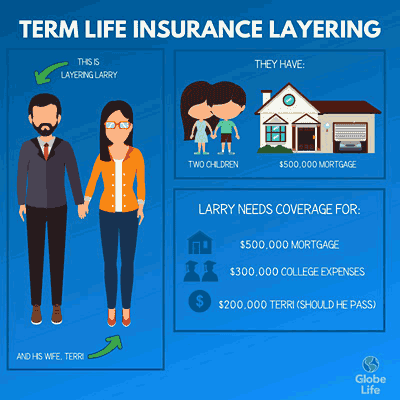

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from