Four Bad Financial Habits You Need To Break Now

By Lucille Reed •

January 18, 2017

Has your personal or household debt spiraled out of control? If you find yourself unable to make ends meet at the end of the month or you are constantly stressed about money, then it may be time to take a closer look at what you’re doing wrong. Bad habits can hurt your finances. The following are four harmful financial habits you need to break now.

- You mistake credit for wealth. Revolving credit card debt still accounts for a majority of personal and household liability in the U.S. Credit card borrowing continues to rise, despite how damaging it can be for those who don’t distinguish between credit and wealth. A credit line is an available amount of money you can borrow. Your wealth on the other hand is a measure of the value of the assets you actually own. Wealth can take the form of money, property and personal items.

Mistaking credit for wealth is a bad financial habit that can lead to serious trouble. Credit lines of any amount can give you a false sense of security or the impression that you have more money than you actually do. This can lead to overspending and the accumulation of major debt. Instead of charging things, strive to save money until you can pay for things instead of relying on credit cards. - You don’t spend money wisely. There is no time like the present to start practicing frugal spending. This is true regardless of whether or not you’re currently doing well or struggling financially. Embracing a more sustainable lifestyle is a major part of practicing smart spending. As long as you’re living and spending beyond your means, you’ll never experience true financial stability. Frugal spending doesn’t mean you have to give up the majority of things you currently pay for. It means reassessing what’s most important and deciding what can be left out of your monthly budget.

Buy items meant to last. Give up things that aren’t essential to your health and happiness. Eat at home more often and shop accordingly. Take public transportation or car pool to work when you can. Don’t always think you have to have new technology right when it hits the market. There are hundreds of ways to start spending money more wisely that you can start today. Do your research and start incorporating them into your daily life now. - You don’t have a plan. As with anything in life, if you don’t have a solid financial plan, then there’s no telling where you’ll end up. Building financial security takes careful planning. Motivate yourself to save more money by setting goals. You may start saving for a major purchase or to pay for your education or a trip. You can also set a financial goal as to how much cash you’d like to have in your checking or savings by the end of a set time period.

Keep track of your financial goals and hold yourself accountable. You can plan a monthly budget and then make saving for a financial goal part of that budget. Once you’ve worked out a reasonable monthly budget, stick to it. This is an excellent way to change your bad financial habits to good ones. - You are not saving for retirement. Think you’re too young or just too broke to save for retirement? If so, then you’re most likely guilty of this bad financial habit. When you’re in your twenties and thirties it’s easy to convince yourself to put off saving. However, the earlier you start the more interest your money can earn over time. Giving your earnings time to compound means you won’t have to put away as much to have a comfortable nest egg in the future.

Start saving for retirement as soon as possible. Try to put away between 10 and 15 percent of your income at least. If you’re already in your 40s and have yet to begin saving for retirement, then you’ll want to work out a plan to put away more. Take advantage of any work retirement plans such as 401(k) plans to help save more. Opening up an individual retirement plan (IRA) is another excellent way to save for retirement.

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

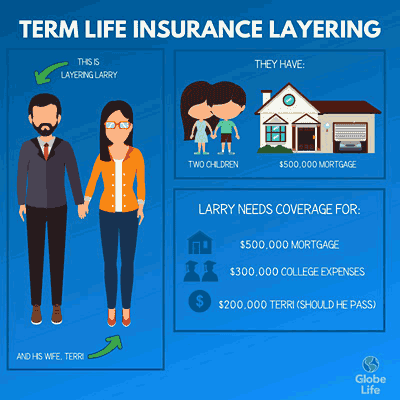

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from