Ten Essential Tips for Managing Your Personal Finances

Regardless of your income level or marital status, managing your personal finances is key to financial success and peace of mind. Money matters can become a serious source of stress, which can then spill into all aspects of your life. These ten essential tips can help you manage your personal finances and build a solid financial future.

#1 – Plan Your Monthly Budget

Planning a monthly budget will enable you to track where your money is going. Review your total spending from the previous few months. You'll probably be surprised to find out just how much you're spending on "luxuries" such as dining out. To plan out your new budget, start with the essentials, such as mortgage and utilities, food and gas. Leave some extra money for "luxury" spending, and don't exceed that amount.

#2 – Start an Emergency Account

Financial emergencies are always headaches. But an emergency account can mean the difference between a minor ache and a migraine. Start an emergency savings account and save up at least enough money to pay all of your monthly bills for three to six months. This way you will not have to borrow, default on loans, or get a cash advance if you have a financial emergency.

#3 – Check Your Credit Reports

Check your credit reports at least once per year. You can do this at annualcreditreport.com. There is no charge to view all three of your credit reports one time per year. If all is in good order and you are on top of your finances, you should not need to pay to check them more often. If you see a mistake on any of your credit reports, report that mistake.

#4 – Pay Down High Interest Accounts First

Paying down any credit debt you have will not only alleviate you from carrying personal debt, it will raise your credit score. But focus on paying down accounts with the highest interest rates first. Interest is where credit companies make their money and where you lose yours.

#5 – Pay Bills on Time, Every Time

Making late payments will seriously hurt your finances. For one, it ruins your credit, leading to raised interest rates, less credit offers, and a lower credit score. But late payments also usually result in high late payment fees, sticking you with even more debt.

#6 – Take Advantage of Online Banking

Online banking allows users to monitor their banking accounts from a PC or smartphone. You can pay bills, check account levels, make a transfer, and even make deposits using online banking. Banks have measures in place to ensure secure online banking experiences. Take advantage of those measures and use common sense and online banking can be an excellent tool for managing your personal finances.

#7 – Start a Savings Account

A checking account constantly has money revolving through it. But if you want to save money, you need to keep that cash in a separate savings account. This account should be different from your emergency account, which should only ever be used in the case of a true emergency. Try to pick an account with a decent interest yield.

#8 – Start an I.R.A

I.R.A stands for Individual Retirement Account. There are different types of I.R.A's and how they're set up can vary as well. You can start an I.R.A regardless of whether or not you have a retirement savings through your job. Individuals can deposit up to 5,000 per year tax-exempt into an I.R.A and couples can deposit up to 10,000.

#9 – Don't Take on High Interest Debt

Taking on high interest debt isn't ever smart idea. If your credit is bad, fix it before taking on another loan and get a better rate. If you absolutely don't have a choice, pay off the high interest loan as quickly as possible. It all boils down to making good choices. Sure, you might look hot riding in that brand new, cherry red convertible, but if you're paying an interest rate of 10 percent to get it, then you'll soon realize you should have waited for a better deal.

#10 – Buy with Cash

The same ten dollar item costs ten dollars if you buy it with credit or cash, right? So why buy with cash? The answer is easy. When you buy with a credit card, it's harder for your brain to really register how much you're spending. Just a swipe of the card and the items are yours. But when you purchase your items with cash, you really notice that money and where it's going. Also, buying with cash means you can't spend more money than you actually have.

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

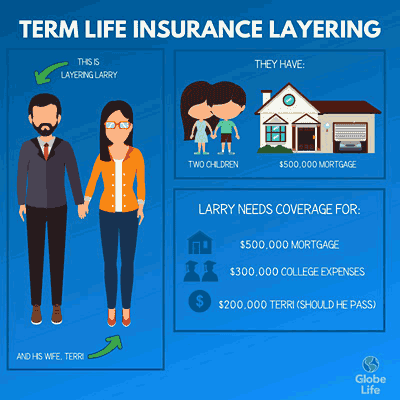

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from